What is “YNAB” and why am I reviewing it? Well, because it has changed the course of my life, and I think you should know about it. But we’ll get to that in a minute.

A while back, I discussed the best gift you can give your future spouse. You hear so much about keeping yourself sexually pure before marriage, but bringing financial baggage into a marriage can be just as damaging. I even mentioned how being debt free can make you more attractive to the opposite sex.

But to be sexy in the future, you have to do something that may not sound sexy today.

What is the first step in getting your financial “house” in order? I hate to even say it because you’ll stop reading this article.

The first step is the B-word — budget.

I know, I know…you’ve heard the “B” word a million times, and you’re simply not going to do it.

But hear me out.

If you can answer “yes” to ANY of the following questions, then you need a budget:

- You’ve had financial anxiety in the past 6 months

- From time to time, you have an emergency expense (car breaks down, health problems, etc.) that you’re not prepared for and you have to put it on your credit card because you don’t have the cash to pay for it.

- You pay the minimum amount on at least one credit card each month.

- You keep raiding your savings account to pay for this month’s expenses.

- You have no idea how much you spend on eating out, buying clothes, or gas each month.

- You can’t seem to save up for a large purchase so you end up putting it on a credit card or financing plans (e.g. new TV, car, furniture, etc.).

- You’re breathing.

If you want to make any progress on your finances, then the absolute first step is to simply tell your money where to go (budget). In our modern era, money moves very quickly and if you don’t tell it where to go then places like restaurants, coffee shops, and Amazon will take it away from you. I’ve never accidentally dropped 200 bucks in savings account, but I certainly have on Amazon.

Thankfully, there are also tools in this modern era which actually make budgeting easy and allow you to have complete control over each dollar.

For the past two and a half years, I’ve been using You Need A Budget software, or YNAB (pronounced “Y-NAB”) for short.

For the past two and a half years, I’ve been using You Need A Budget software, or YNAB (pronounced “Y-NAB”) for short.

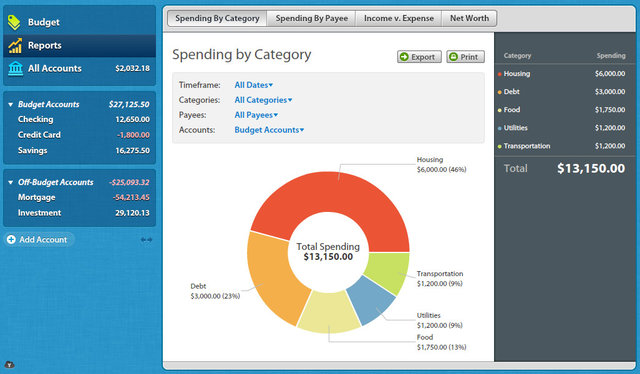

I’ve tried just about every personal finance software option out there, and I’ve never had this much control over my money — ever. I finally feel like I’m being a good steward of the resources God has blessed me with. I wanted to write a YNAB review so that SingleRoots readers who struggle with their finances could know about this tool that could help them.

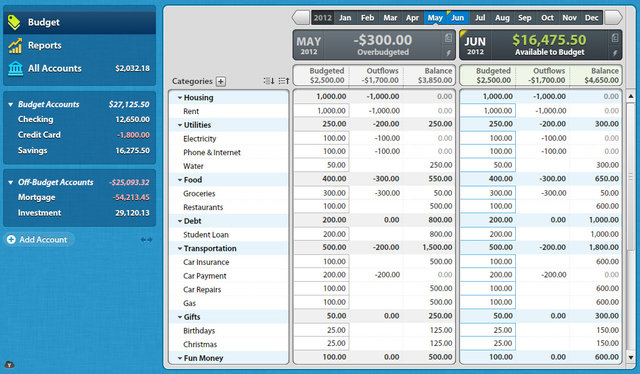

YNAB works on a simple, yet powerful 4-part methodology. This is their explanation:

1. Give Every Dollar a Job

Instead of deciding to buy something based on the big (or small) pile of money in your checking account balance, you’ll decide based on a category balance.

Without Rule One:

You see the $500 account balance, get the false idea that you’re flush with cash, and go out for sushi at your city’s finest for $100. A few days later some bills you had forgotten about are due and you find yourself in a pinch.

With Rule One:

You have $500 in your checking account. You give each of those dollars a job by dividing the $500 into various categories:

Food — $150

Eating Out — $10

Gas — $40

Utilities — $100

Car Payment — $200

Total Budget — $500Your friend invites you to go out and get some sushi.

You don’t look at your $500 account balance and say, “Wow, that’s a ton of money! Sure!” You look at your “Eating Out” budget balance of $10, wince, then smile and invite your friend over to split a $5 pizza. A few days later, those forgotten bills arrive and you pay them with ease.

2. Save for a Rainy Day

There are no normal months. Your expenses do not occur evenly throughout the year, and if you don’t plan for the high-expense months, you’ll be in a world of hurt. Rule Two forces you to look at the larger, less-frequent expenses (car insurance, life insurance, Christmas, school tuition, VACATIONS) and break them down into monthly, manageable amounts.

Without Rule Two:

You see you have $1000 in your checking account, do some quick (almost always faulty) math in your head and remember your cable bill is due in two days ($100), the refrigerator is empty ($150), the car payment is due next week ($400), and the gas bill needs to be paid by Friday ($120). Total bills tallied in your head: $770.

You think you’ve got some extra cash! $1000 less $770 means you have $230 of impulse-shopper money!

A week later, with $100 in your checking account (you impulsed away $130 already), your car insurance bill is due. You owe them $600. Keep your hands and feet inside the ride at all times…you stress. You put it on the card. You dig yourself a bit deeper into a hole.

Yet you “make plenty of money.”

With Rule Two:

You looked ahead six months ago. You knew the car insurance premium would be due in six months, and you knew it would be $600. You’ve been budgeting $100 per month into your “Car Insurance” category each month for the past six months.

Where has the “extra” $100 per month come from? Probably from your impulse-shopper money. As mentioned with Rule One, when you start giving your dollars jobs, you tend to “get a raise.” Your money is more obedient. It lines itself up with what matters to you. It’s not magic, though it feels that way.

So, snoozer alert: The bill comes, you pay it. That crazy month, that would have sent you into complete and utter panic mode, felt pretty normal. Kind of boring actually. You didn’t even feel the bill.

3. Roll with the Punches

When you overspend in a budget category for the month, roll with it. You make and change plans all the time. If you plan a weekend beach trip, but the day turns out to be rainy and cold, do you still go to the beach? Of course not! When circumstances change, you change your plan. Your budget is no different. If you overspend in a category, look through your budget and move some money around. Remember, you’re the boss!

Without Rule Three:

You feel like a failure. Budgets don’t work. This whole idea of watching what you spend or trying to “guess” what you will spend is a complete waste of time. You don’t “need a budget,” you “need a raise.” If you only earned just a bit more money, everything would be fine! (Those last two sentences are dripping with sarcasm. More money does not help money management problems.)

With Rule Three:

Your budget says—in an überfriendly voice—“Okay, that’s fine. It’s cool. I see you went over in ‘Groceries’ so go ahead and move some surplus money from ‘Clothing’ into ‘Groceries.’” If you don’t make any adjustments, YNAB automatically deducts overspending from next month’s money. You don’t feel like a failure. Budgets do work.

4. Stop Living Paycheck to Paycheck

Spend this month, what you earned last month. How? Save enough money to go an entire month without touching your regular income. Then the next month, spend last month’s income while earning this month’s income. You’ll spend this month’s income next month.

Without Rule Four:

John lives paycheck to paycheck. He knows the date of his next paycheck well in advance, and has a stack of bills he’s timing to go out as soon as the paycheck hits his account. He times bills to paychecks every pay period. This is stressful: juggling due dates, cash flow, and other unexpected expenses (Rule Two). He’s habitually stressed.

With Rule Four:

John has a month’s worth of paychecks saved before the month starts. (YNABers call this their “Buffer.”) When bills arrive, he pays them. He doesn’t worry about when the next paycheck arrives because the money’s already there. He’s habitually happy.

So that is a brief overview of YNAB’s methodology. To read each step in more detail, you can go here.

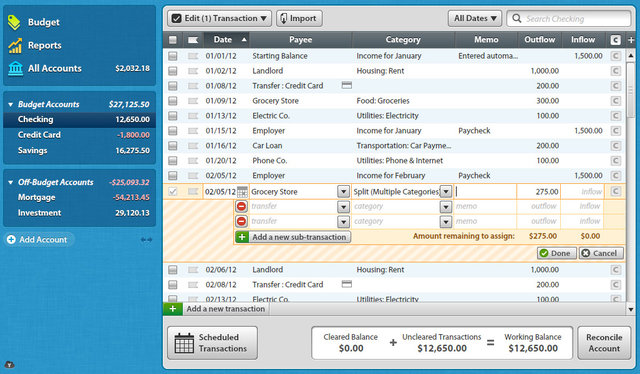

Make Informed Spending Decisions with Cloud-Sync

With the newest version of YNAB, you can carry your budget in your pocket via “cloud sync.” YNAB has created a completely, behind-the-scenes way to seamlessly keep your budget updated on all your devices – laptop, iPhone/Android. Therefore, when you are in the “buying moment” you can simply pull out your phone, see what a category balance is, and make an informed decision. If you decide to make the purchase, you can simply record it on your phone at the register, and it updates your budget on all your devices immediately.

With the newest version of YNAB, you can carry your budget in your pocket via “cloud sync.” YNAB has created a completely, behind-the-scenes way to seamlessly keep your budget updated on all your devices – laptop, iPhone/Android. Therefore, when you are in the “buying moment” you can simply pull out your phone, see what a category balance is, and make an informed decision. If you decide to make the purchase, you can simply record it on your phone at the register, and it updates your budget on all your devices immediately.

Here’s a list that just scratches the surface of what YNAB has helped me accomplish in the last 2 years:

- All my savings “buckets” have increased.

- I made it through a period of time with no income.

- Instead of living “paycheck-to-paycheck,” I now live on last month’s income.

- I have 4 months of living expenses saved up.

- I just paid cash for a car.

- I feel freedom to spend (i.e. If I’ve funded my savings buckets and my entertainment bucket at the beginning of the month, then I can freely spend money on entertainment, without guilt, or worrying about hindering my savings goals).

YNAB is available for both the Mac and PC. The software cost $60, which I found paid for itself in the first month once I became aware of some of the categories in which I was wasting money.

Get a 10% SingleRoots Discount when you use the link below to order YNAB:

Did I mention they even offer a 34-day free trial? Yeah, it’s a win-win.

If you are serious about getting your financial “house” in order, You Need a Budget software will get you on that path.

Have you used YNAB? What’s your experience with the software? Love it or leave it?

*Photo credit:

Disclosure: Some of the links in this post are “affiliate links.” (Translation: If you click on the link and purchase the item, SingleRoots will receive an affiliate commission. But just so you know, we don’t recommend products we haven’t used personally or that we don’t believe will add value to our readers’ lives.) We are disclosing this in accordance with the Federal Trade Commission’s 16 CFR, Part 255: “Guides Concerning the Use of Endorsements and Testimonials in Advertising.”